PLEASE DO NOT LEAVE PAYING YOUR NIE NUMBER TAX UNTIL THE LAST MINUTE!!! Please don’t be the person phoning us an hour before your appointment and unable to find a bank to pay.

PLEASE ENSURE THIS IS PAID AT LEAST ONE DAY BEFORE YOUR APPOINTMENT. This is not always an easy task…..

(if you have a short notice appointment you can pay on the day before your appointment)

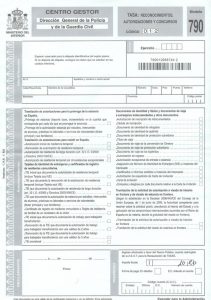

For each new NIE Number application, or replacement NIE Number application there will be an applicable tax payable in advance to the Spanish Government.

The amount owed will be shown on your Form 790 we sent you via email. You need to take this form, which comprises of 3 pages (two identical), to a bank to pay the Tax. This needs to be done before your NIE Number appointment. DO NOT LEAVE THIS UNTIL THE LAST MINUTE AS IT CAN SOMETIMES NOT BE SO EASY…

You may need to try several banks before you will find one which will allow you to pay your NIE Number Tax. In general all Bank Sabadell will accept your form.

Some banks will only accept payments if you hold an account with them, but most national banks will accept your form and payment without an account.

Recently we have found that due to the long ques that processing many NIE Number tax certificates causes some banks will only accept payment on certain days of the week, for example Tuesdays and Thursday.

NIE Number tax Questions and Answers

Q: How much is the NIE Number Tax?

A: Each region of spain is able to set its own fees for your NIE Number tax. This amount will appear on your form 790 and on average is between 9-13 Euros per person.

Q: I’ve gone to the bank but they have said you have completed the form wrong. They say my NIE Number should be on the form.

A: We complete this form over and over again, day after day. We can confirm your form has NOT been filled in wrong.

Not all cashiers are trained in what should be on your form. If you have problems try another bank and another cashier. We can not put your NIE Number on the form as you currently don’t have one.

If you can not find a bank that will accept the form with your passport number put a cross through the number and write in black pen under it:

999999999 or Y6453625Z

PAYING ON A CASH POINT/ATM

CLICK HERE FOR A STEP BY STEP GUIDE TO PAYING YOUR NIE Number TAX ON A BBVA CASH MACHINE

DO NOT leave paying your tax until the day of your appointment.

Q: I paid my NIE Number Tax, but when I arrived at the police station they said it was the wrong amount and sent me back to the bank to pay more. Why didn’t you tell me?

A: Each region has the ability to set its own Tax Rate. Where possible we try and issue forms with the correct tax rate, however, since the time we issued you the paperwork the police may have changed this amount, which they are not required to notify us or anyone about. The amount may be as little at 10c. This will not affect your NIE Number application but in certain circumstances may require you to revisit the bank to pay the extra amount owed.

Q: I seem to be going around in circles, the bank will not accept my form 790 tax without a NIE Number and the Police will not give me a NIE Number without paying the form 790 NIE Number Tax. What do I do?

A: Welcome to Spain! This type of situation is not uncommon in Spain. The only answer is to keep trying different banks until one says yes. Crazy? Absolutely! Alternatively cross out the passporrtrt number on your paperwork and write in black pen the following number: 999999999

Q: I have been refused a NIE Number. Have I lost the Tax I paid or can I use it for my new appointment?

A: If your application for a NIE Number was not successful you can still keep the paid form 790 for 1 year from the date you paid the fee and use this at another appointment.

Q: My region only offers joint NIE and residency applications. Why have you still sent me a 790 Tax Form?

A: If you are lucky enough to live in one of the regions which offers a joint NIE Number and residency application system your tax will be slightly higher. The police station will issue you with a new form 790 to pay on the day if this is the case.

Q: If I use the atm cash machine I won’t have a stamp on my form. How does this work

A: If your using the atm cash machine you will get a printed receipt one you have completed the payment. Instead of having a stamp on your form 790 you attached this recipe to your form in its place.

We have said it above but to be sure once again…. Please pay your NIE Number tax as early as possible. Do not leave it until the day of your appointment to pay the Tax. Your appointment will fail if you have not paid the tax in advance.

Internal Links

Help I’m having an absolute nightmare I have tried every bank and non will let

Me pay my tax. I have my nie number appointment at 11am

Hi Rose. You need to try several banks. Did you booked your NIE Number appointment via us I cannot find any record of you? Lisa

😂 bravo on these instructions! I would have been lost otherwise! Tax paid! Many thanks, Ross

Thank you ross 🙂 A lot of people don’t read them unfortunately…

Lisa

https://www.mynie.co.uk

What was the instructions I tried the bank No one spoke English and I tried the atm when I got to the payment part it took the payment then gave me back the money and said not excepted I had no problems with anything else until the atm asked for the 10 euros to it the tax and gave it back and help ?

Hi! What are Y6453625Z and X4876037Z? Is it a code of a specific bank or something?

Hi Maria

These look like NIE Number?

Lisa

https://www.mynie.co.uk

I went to many banks and they all told me that I need to pay the módulo 790 with an atm, is it safe to enter the nif that you told to enter (X4876037Z) maybe it will be a problem to get the nie if it’s not my nif number?

Hi

please call the office if you still need help with this 0034 665556070

Lisa

Hello can you pay your Tie tax, in another region and take to the region you intend to process your documentations.

Thanks

Hi

Yes, thats fine,.

Lisa

Bonjour, j’ai rempli le formulaire du paiement de la taxe et j’ai sélectionné le virement avec l’iban plutôt que le paiement cash.

Est-ce que j’ai besoin d’un tampon d’une banque ? Je n’ai pas encore été prélevée du montant mais mon Iban est bien précise sur le papier

We are having trouble helping an OAP. His passport , payment methods are English , his address is Spanish

This is causing problems when choosing a language (English) to fill the document on line in

The English page will not accept his address. Its asking for English counties

Also post code issues are the same

Its impossible to fill out an English document in half English half Spanish text

We need some advice or support please

07772269977. John

Hi

I believe we have now sorted this with John and he has his NIE?

Lisa

https://www.mynie.co.uk

Hi, my wife is a resident and I am trying gain residential status. I have been to many meetings but there is always a problem with a form etc. I am relying on friends at the moment for transportation.

I live in Novelda and am finding it difficult to get a bank to accept payment.

Can I go to the imegration office in Alicante and get both done at once?

Many thanks.

Hi

Please call the office on 0034 665556070 to discuss.

lISA

We are staying in Valencia but we are scheduled for an appointment in Alicante. How do we know what the fee is in Alicante if we are to pay it in advance? Aren’t there any fee announcement pages for the fee? Thank you!

Bună va rog sa ma ajutați încerc sa plătesc taxa pt nie la bănci și tot îmi da ca formularul nu e corect iar când am fost la politie mi au spus sa mai încerc și mi au schimbat nr de nie și tot nu merge tot asa îmi da,cei de la politie tot asta îmi spune sa mai încerc dar la nici o banca nu merge. Va rog sa îmi dați un sfat

Super, super, super!

We’ve got an account with an internet bank (Bunq), so no way to get a proper payment receipt. Nobody (not even Spanish gestors and government officials) could help us out. With your BBVA ATM trick everything went smooth. Took all of 2 minutes. A most welcome shortcut through Spanish paper-hell.

Glad it worked!

Hi – I couldn’t get the bank to accept my passport number or the one starting Y…

They did accept X4876037Z that was listed further up. Will this still be OK for the police appointment ???

Thanks.

Hi

Yes this will be fine.

Lisa

https://www.mynie.co.uk

This was so helpful regarding the payment of the modulo with the cash machine! At the bank desk they told me it was not possible, it always showed them error! With your guide I was able to pay the tax with BBVA at the cash machine without much trouble… thanks a lot…

UPDATE AU 7 OCTOBRE 2022:

J’ai payé la taxe du NIE dans un BBVA ici en espagne la semaine dernière. Et cela a marché avec le nie délivré ici commençant par Y.

A mon rdv de ce matin au commissariat de Bailen, le mr du bureau m’a dit que ce n’est pas le bon fonctionnement et que cela ne marche pas comme ça. J’ai du aller à la banque Cajamar pour payer à la machine. Vous pouvez et devez mettre votre numéro de passeport. Sinon ils ne vous accepteront pas le paiement.

this worked. thank you so much I’ve been trying to pay the tax for almost a week before I found this page.